Quick Analysis: Google-PayPal Partnership

What this partnership means for your portfolio

Google (GOOG 0.00%↑ & GOOGL 0.00%↑ ) and PayPal (PYPL 0.00%↑ ) announced a multi-year strategic partnership last September, representing a significant inflection point for both companies. Relevance for investors: This alliance combines PayPal’s payment infrastructure with Google’s commerce ecosystem and AI capabilities, positioning PayPal as the preferred partner across multiple Google platforms (Shopping, Maps, YouTube) and substantially improving its commercial reach.

Immediate recommendation:

This news reinforces the investment thesis for PayPal as a quality asset. The partnership directly addresses two historical weaknesses:

Limited distribution versus vertically integrated competitors, and

Insufficient monetization of its user base. Hold or increase position if present in portfolio.

News Context

What was announced?

Integration of PayPal as a payment method in Google Shopping, Maps, and YouTube

Deployment of AI technologies for shopping personalization and deal detection

PayPal as preferred payment partner in Google’s ecosystem

Collaboration on the development of AI-powered commerce tools

Relevant timing:

The announcement comes at a strategic moment as PayPal seeks to counter competitive pressure from Apple Pay, Stripe, and B*uy-Now-Pay-Later (BNPL*) solutions. At the same time, Google aims to monetize its commercial search traffic more effectively.

Impact Analysis

For PayPal (PYPL)

Positive 🟢🟢🟢:

Distribution scale: Access to trillions of monthly commercial searches on Google

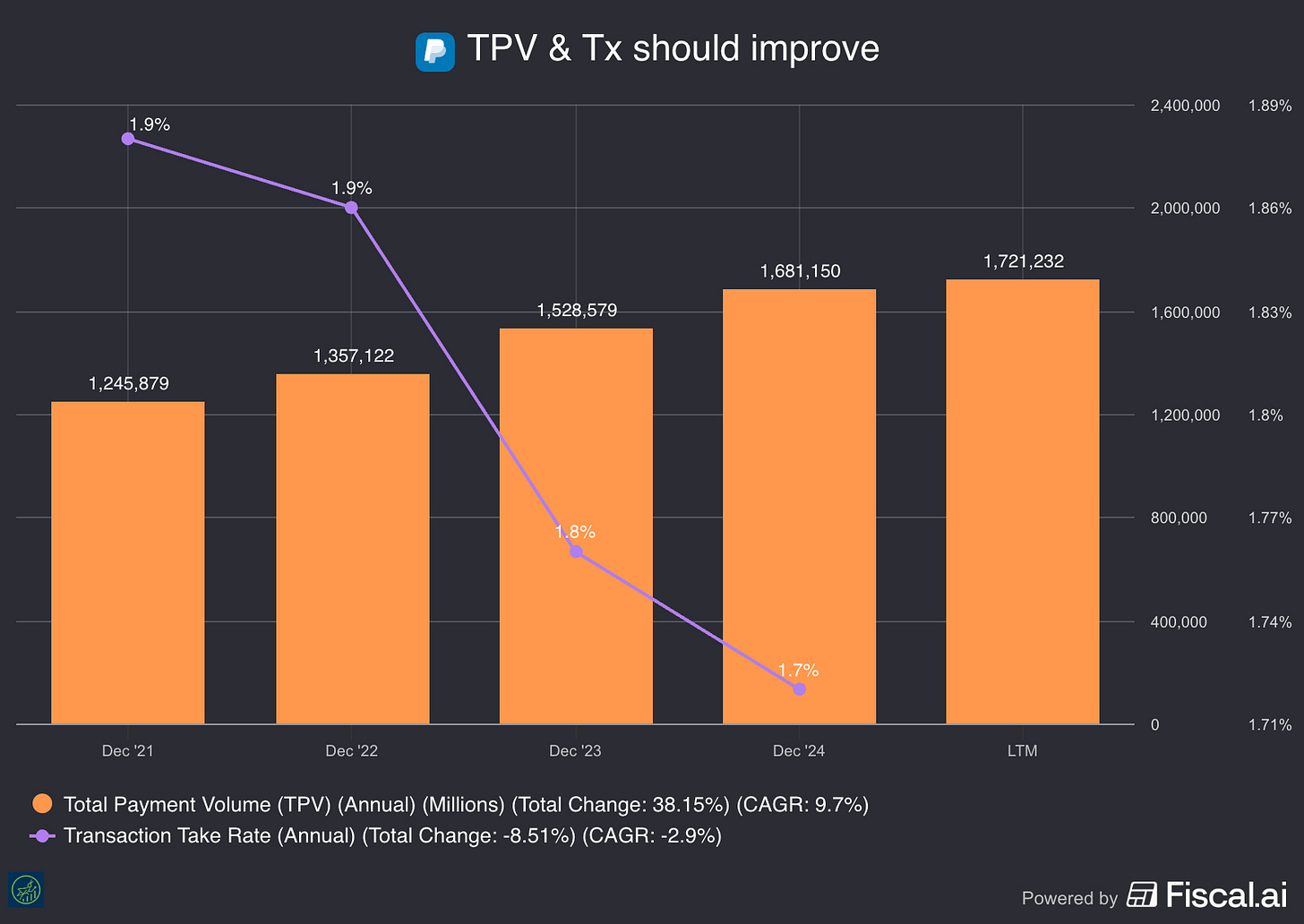

Growth reactivation: Potential significant increase in transaction volume (TPV)

Competitive differentiation: Preferred position vs. competitors on key platforms

Improved monetization: Higher average take rate from higher-value transactions

Strategic validation: Positive signal about PayPal’s competitive relevance

Considerations:

Financial terms not disclosed (revenue share, integration costs)

Technical execution and implementation timing pending

Increased dependence on a strategic partner

For Google (GOOGL)

Positive 🟢🟢:

Simplified checkout experience for users

Improved conversion rates on Shopping and YouTube

Access to proven payment infrastructure without massive development investment

Transactional data to improve recommendation and advertising algorithms

Quality Investment Perspective

High-Quality Fundamentals

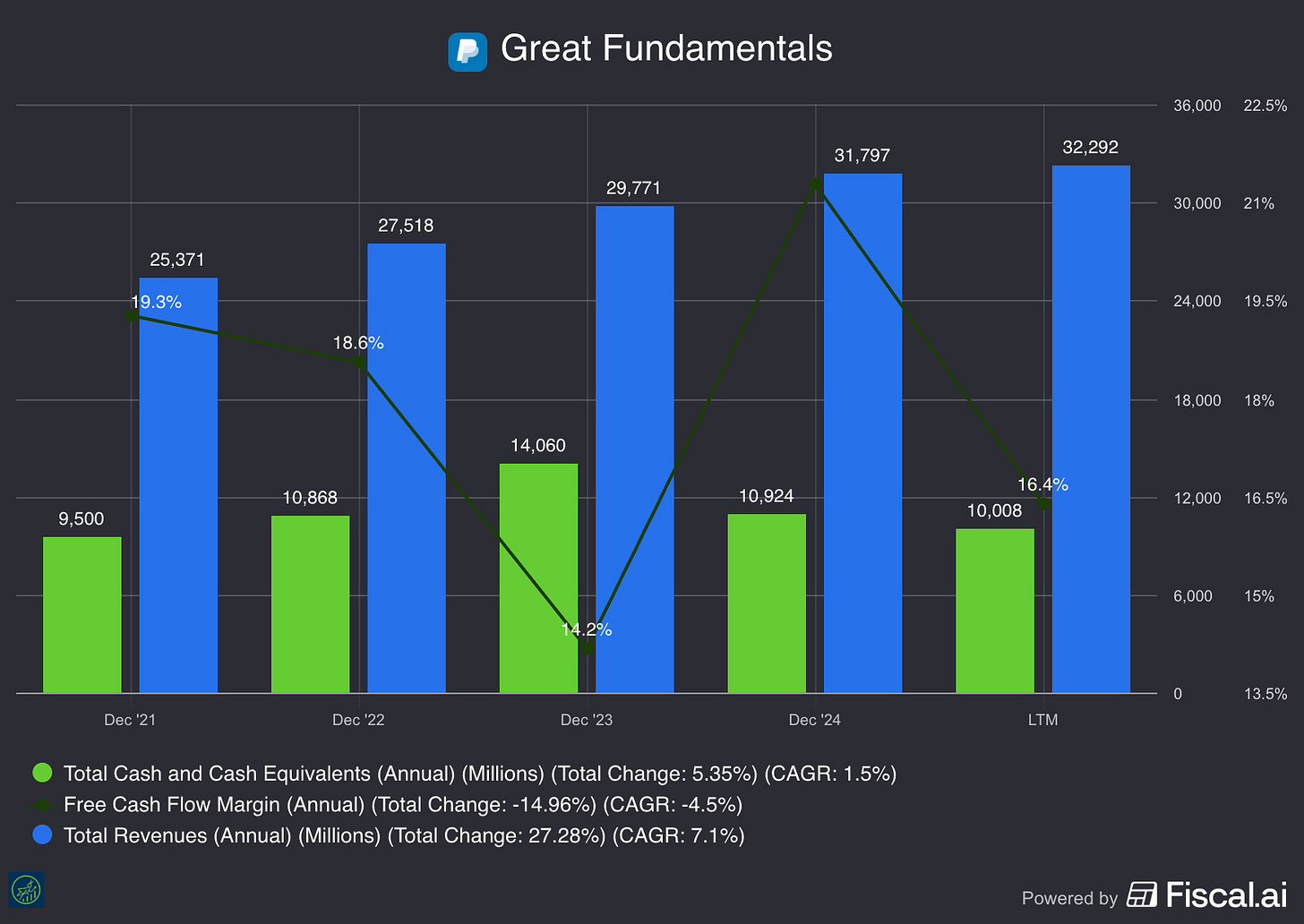

PayPal maintains quality asset characteristics:

Strong cash position (~$17B in cash and equivalents)

Consistent free cash flow generation

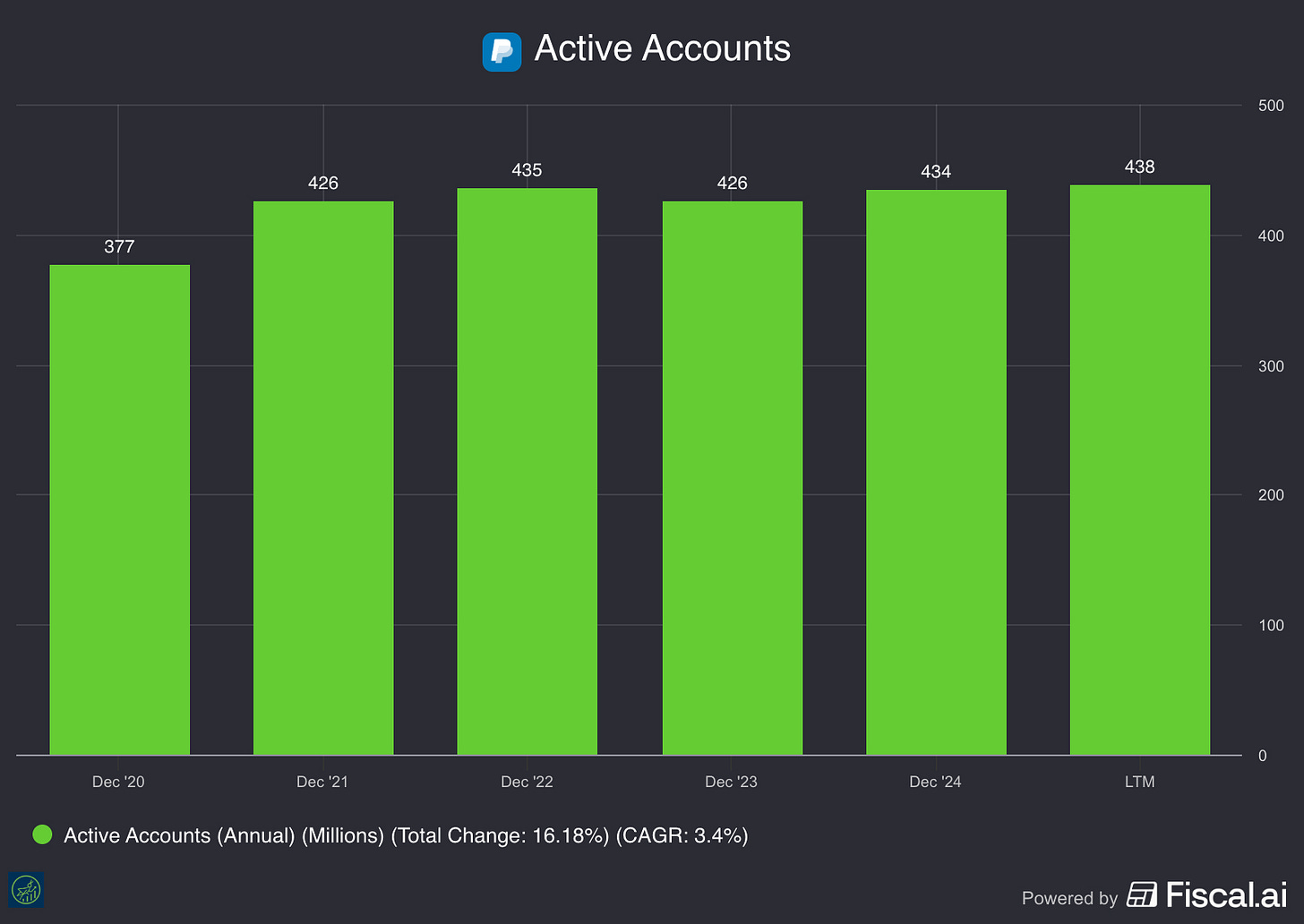

Network effects with 430M+ active accounts

Proven and scalable technology infrastructure

PayPal is one of the healthiest companies and operates a remarkable free cash flow machine.

Active accounts have remained stable, demonstrating PayPal’s dominant market share. This is a strong indicator of resilience. PayPal is strategically focused on efficiency and long-term growth drivers.

This alliance reinforces:

Long-term business model sustainability

Adaptation capacity and strategic partnerships

Competitive relevance in the digital payments ecosystem

Risks to Monitor

Partner concentration: Greater dependence on Google’s strategic decisions

Margins: Possible pressure if commercial terms are unfavorable

Competition: Apple, Amazon, and others won’t remain passive

Execution: Speed and quality of technical integration

Key Post-Announcement Indicators

Metrics to track in upcoming quarters:

TPV growth: Acceleration in total processed volume

Active accounts: Reactivation of inactive users or new registrations

Take rate: Improvement in revenue per transaction

Marketing efficiency: Reduction in CAC (customer acquisition cost) through organic distribution

Management guidance: Updated projections for 2025-2026

TPV has been consistently increasing, and although the transaction rate has experienced a decline, PayPal is well-positioned to improve this trend over the long term.

Quick Scenarios (12 months)

🟢 Positive scenario (probability: 60%)

Successful integration, TPV grows 15%+ YoY

Take rate improves 5-10 bps

Stock toward $95-100 (+25-33%)

🟡 Base scenario (probability: 30%)

Gradual implementation, modest short-term impact

TPV growth 8-10% YoY

Stock toward $85-90 (+13-20%)

🔴 Negative scenario (probability: 10%)

Technical issues or unfavorable commercial terms

No material impact on metrics

Stock sideways $70-75 (0-5%)

Valuation

PayPal has formed numerous strategic partnerships, which have significantly strengthened its business. The upcoming launch of their Ads platform is poised to become a major driver of future revenue growth.

I confidently project a reduction of up to 22% in shares over the next 18 months. Braintree and Venmo are currently leading revenue growth, and Fastlane, BNPL, and the Ads platform are positioned to be key catalysts for the company’s continued expansion.

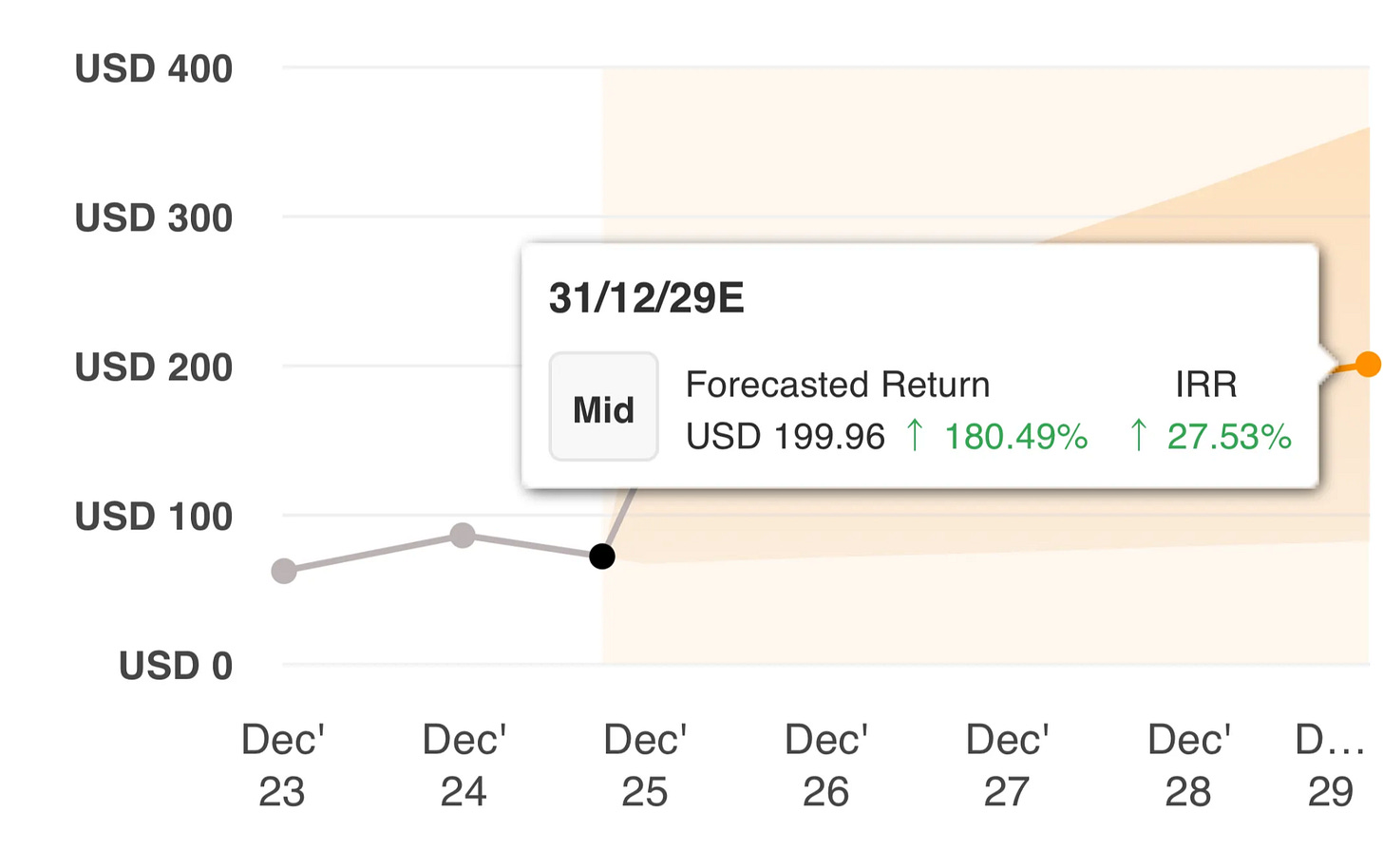

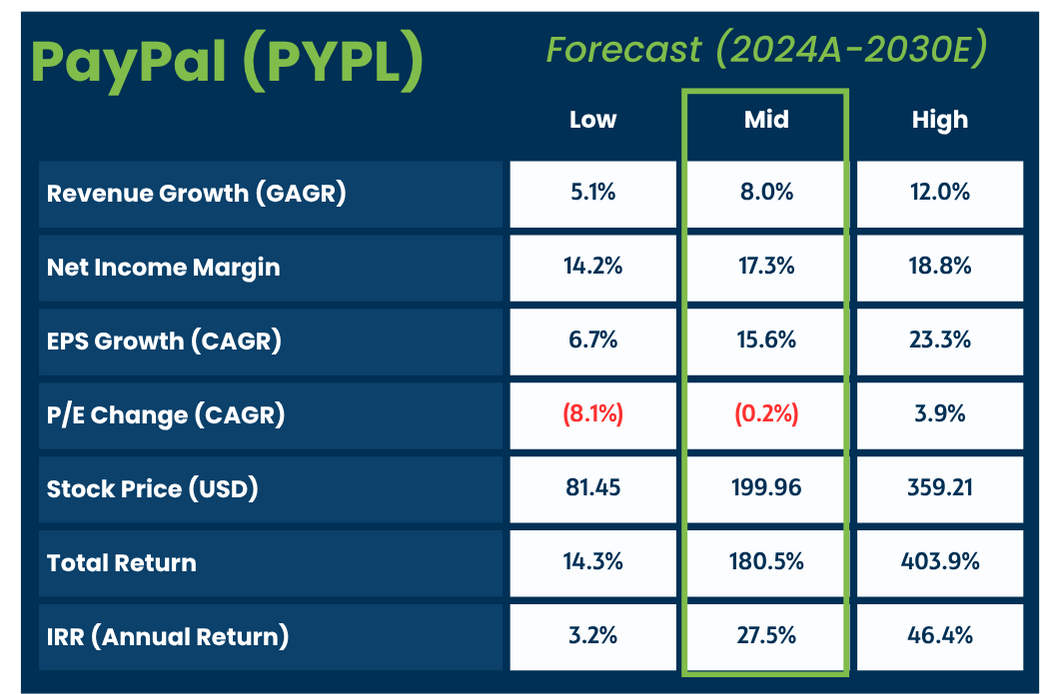

Let’s take a look at a conservative valuation using the mid-case scenario, where growth has a slight acceleration, buybacks are aggressive, and they manage to improve their margins slightly.

Revenue Growth (CAGR) 8.0%

Net Income Margin 17.3%

EPS Growth (CAGR) 16.6%

Terminal P/E Multiple (CAGR) 18x

Target Price USD 199.96

Total Return 180.5%

IRR (Annual Return) 27.5%

PayPal presents a highly compelling investment opportunity under a conservative scenario. With annualized returns of 27%, it stands out as an exceptionally attractive company.

Based on my mid-case assumptions

📈 Current Stock Price: USD 71.29

🎯 Target Price: USD 199.96

💸 Potential Total Return: +180.5% over the next 4.2 years

📆 Annualized: 27.5% / year

Valuation Scenarios: Bear, Mid, Bull

Let’s break down PayPal’s outlook over the next few years using three valuation scenarios—bear (“Low”), base (“Mid”), and bull (“High”)—to illustrate the range of possible outcomes:

🔴 Bear Scenario (“Low”):

If PayPal’s growth remains subdued and margins compress, annualized returns stay low. Even with limited buybacks and muted earnings growth, investors avoid a major loss, projecting a modest total return of 14.3% and annualized IRR near 3.2%. This scenario reflects market skepticism and minimal recovery.

🟡 Mid Scenario (“Mid”):

With moderate revenue growth (+8%), stabilized margins (17.3%), and balanced P/E, the stock could deliver a +180.5% total return by 2030, annualizing at 27.5%. This outcome is seen as a “safe” investment: not overly optimistic, but offering attractive medium-term upside.

🟢 Bull Scenario (“High”):

If PayPal accelerates growth (+12%), achieves margin expansion (18.8%), and multiples improve, the share price could rise sharply to $359.21. This would produce a remarkable total return of +403.9% and a 46.4% IRR per year. This scenario demonstrates the potential for outsized gains if the company outperforms consensus.

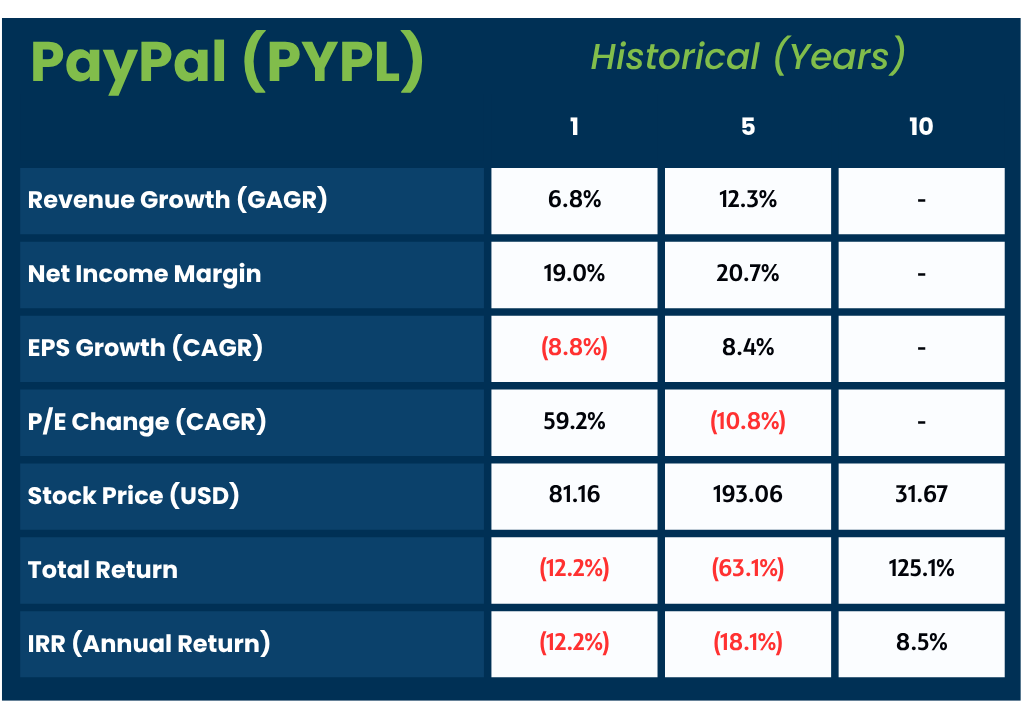

PayPal has historically underperformed, with losses for 1-5 year holders and minor gains over 10 years. Still, it’s one of the most interesting ideas today.

The table above displays the numbers for each scenario, allowing a side-by-side comparison of revenue growth, profit margins, price targets, and total returns.

Recommendations

If PayPal is in the portfolio:

✅ HOLD: Fundamentals remain solid with a positive catalyst.

✅ BUY: If weighting is <5% of portfolio and fits risk profile.

⚠️ MONITOR: Watch Q4 2025 earnings for first quantitative signals of partnership impact.

If not in portfolio:

✅ BUY: Attractive entry on pullbacks toward $70–72.

✅ HOLD: Suggested allocation of 3–5% for a moderate growth profile with high-quality bias.

📊 ALTERNATIVE: Wait for the first quarterly report post-integration for confirmation.

Diversification considerations:

If significant fintech exposure (SQ, V, MA) already exists: Evaluate sector concentration.

Moderate correlation with tech growth, providing moderate diversification versus pure FAANG.

Conclusion

This alliance represents a fundamental catalyst for PayPal, reinforcing its position as an institutional-quality asset. The combination of attractive valuation, solid fundamentals, aggressive buybacks, and a new growth vector makes PYPL a compelling investment idea for high-quality portfolios with a 24-month horizon.

Rating: ACCUMULATE (on pullbacks toward $70-72 zone) / HOLD (current levels)